05/04/2023

Key trends driving the US wine market in 2023

IWSR analyses the performance and outlook for the US wine market

The US wine drinking population has recovered from Covid-era lows thanks to a revival of the on-premise. The premiumisation trend also persists, and there is renewed momentum within the under-40s. However, the longer-term challenges of falling volumes and declining wine knowledge persist, prompting wine brand owners to rethink go-to-market strategies.

Structural challenges persist, but opportunities lie amongst the under-40s

Since the pandemic, there’s been a bounce-back in overall wine participation rates in the US: the number of regular wine drinkers (RWD) grew by 14 million between 2021 and 2022. This momentum is mainly coming from those under the age of 40, and the wine industry is seeing a growing influence not just of the most engaged consumers (aged 25-54), but also of LDA Gen Z to an extent.

Yet despite this boost to the drinking population, overall wine consumption volumes in the US still dipped -2% in 2022, and IWSR forecasts the trend of gentle decline continuing. This is partly because younger LDA+ monthly wine drinkers (31% of whom are under the age of 40) are now drinking wine on a much more occasional basis, although tending to spend more money when they do buy wine. In fact, while total volumes of wine declined in the US in 2022, the premium-and-above segment grew by +6%, according to preliminary IWSR findings.

The more engaged wine drinkers drive premiumisation

Premiumisation is a noticeable trend across the US wine landscape, with wealth and engagement key factors. Within this landscape, the $10 price point per bottle is a clear divide. Below this level, volumes are falling and are forecast to continue to do so; above it the reverse is true.

Disposable income is a factor – regular wine drinkers are significantly more likely to have a combined income of $80,000+ than they were in 2018. But so too is attitude. The number of those who are highly involved in the category (as defined by curiosity, commitment and willingness to spend more) has increased from 24% in 2019 to 32% in 2022. By contrast, those with low involvement has dropped from 23% to 17% over the same period.

Increasingly, the US is becoming a two-pronged wine market, where less-engaged, more price-sensitive (and often older) consumers are reducing their activity or leaving the category altogether, and more engaged, regular (typically younger adult) consumers exert an ever-greater influence. While the most engaged Gen X and Millennial consumers make up just under 30% of total regular US wine drinkers, they account for nearly 60% of the total wine spend.

Consumers are exploring – and established brands are losing mindspace

The demographic shifts outlined above have had a significant impact on what US wine drinkers are purchasing. Experimenting with different wine styles is a key trend for all age-groups under 55 and very few like to stick with what they know.

This willingness to experiment has meant that the big established names of the wine world – whether countries, grape varieties or brands – no longer have the resonance with US wine drinkers that they once did. The return of the on-premise and the addition of newer wine drinkers post-pandemic has brought in people who are less familiar with established mainstream brands and are increasingly purchasing wine outside of grocery and chain stores, where those brands are more visible. Awareness of country of origin and wine regions is either down or flat across the board compared to 2019.

Sparkling is a well-established bright spot, while no/low is one to watch

While volumes for still wine – and the total wine category – are in decline, sparkling wine recorded its 21st consecutive year of both value and volume growth in 2022. The more premium segments ($40+ for Champagne, $10+ for other sparklers) are forecast to see the strongest growth over the next five years.

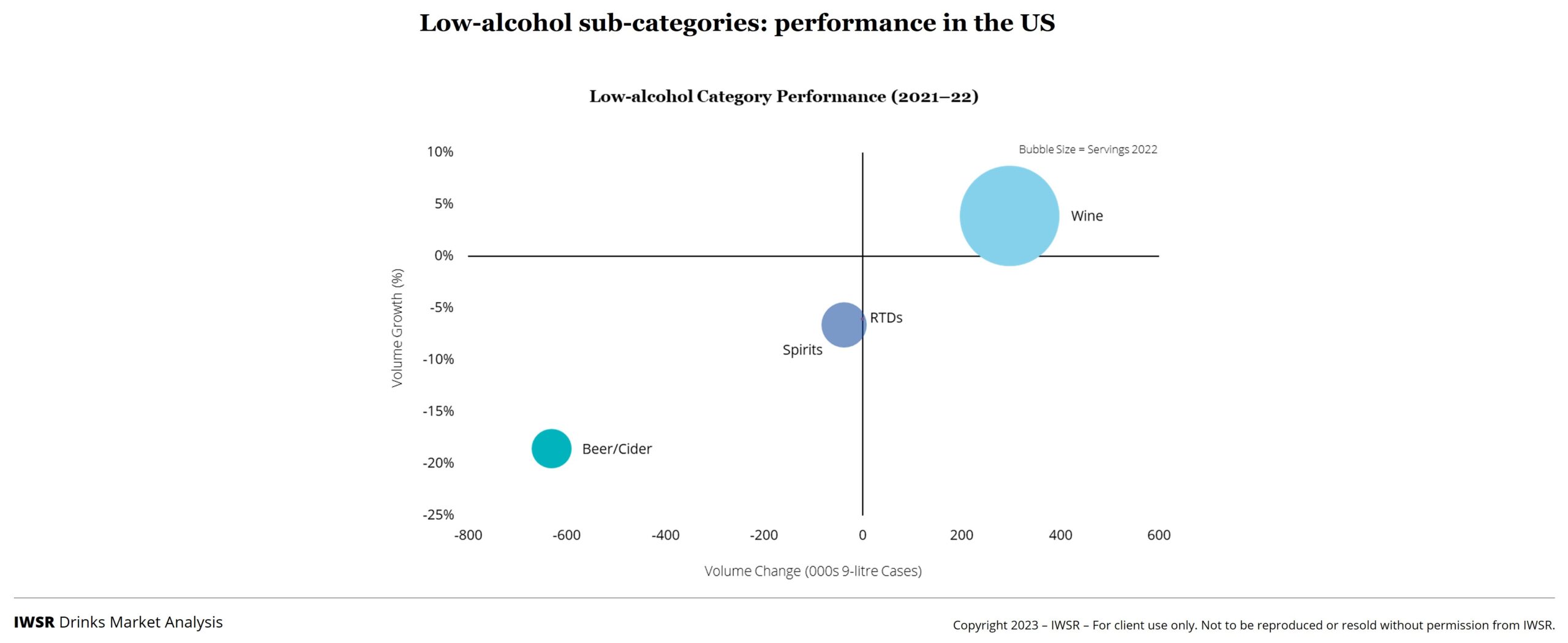

Another wine sub-category with a positive outlook is no/low-alcohol wine. Though the overall no/low sector (across all alcohol categories) is still very small (just 1% of total US beverage alcohol volumes), more than half of all US beverage alcohol drinkers state they want to moderate their intake.

Wine leads share of the low-alcohol category in the US, and is the only low-alcohol segment showing growth. Wine has just begun to leverage health and wellness attributes – such as lower ABVs, less sugar and fewer calories – to entice consumers into the segment. The reduction in ABV within wine tends to be more appealing to consumers than no-alcohol options due to its ability to maintain the wine’s taste profile

The on-premise recovers

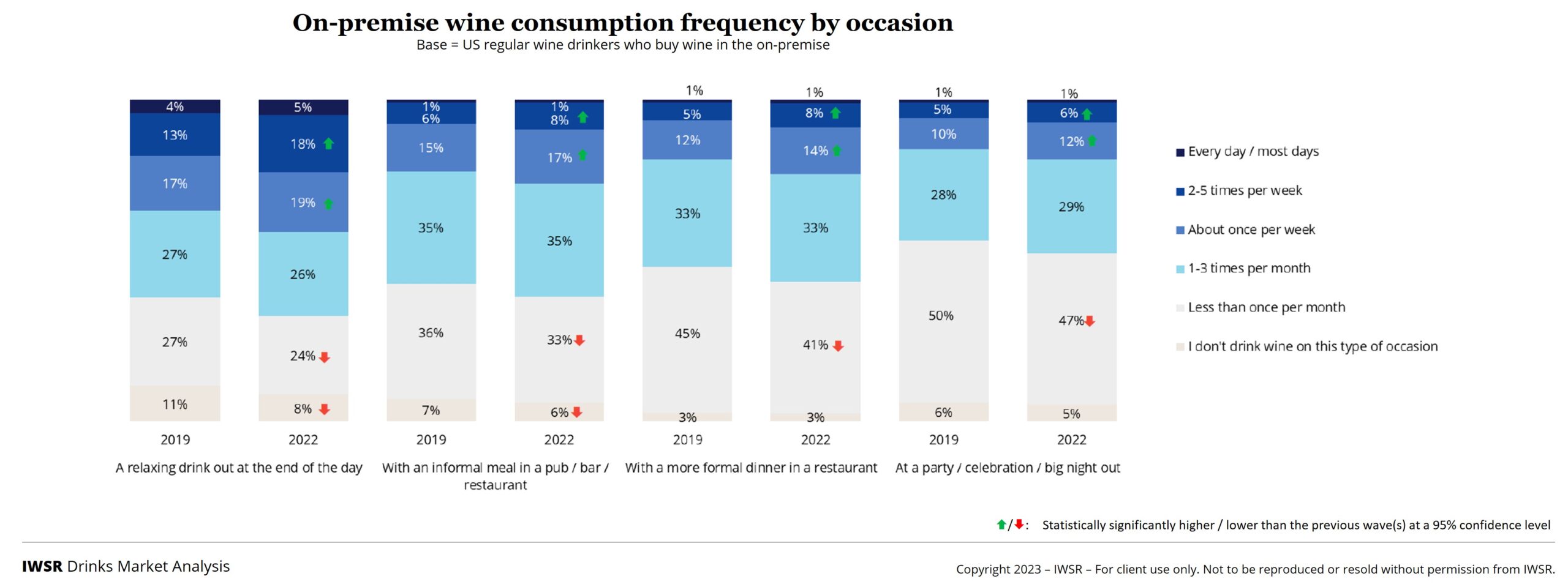

The return of the on-trade, especially bars, has helped to bring younger adults into the wine category. Consumption levels in the on-trade are now higher than pre-pandemic. The strongest growth has come from the most engaged consumers, with those who go out less than once a month reducing even those low levels of involvement in the wine category. While on-trade spend per bottle has seen double-digit increases over the last three years, much of this extra spend will have been outstripped by inflation.

Consumer sentiment and opportunities to capture share of market

Generally, American regular wine drinkers hold a positive view of their personal finances. However, there is evidence of switching to cheaper products, with inflation driving more spend on everyday goods. Within wine, average spend has increased as volumes decline, reinforcing a long-run premiumisation trend that’s here to stay, and one that’s particularly driven by more engaged, regular, and typically younger adult, wine consumers. While some premiumisation is due to higher prices, IWSR data suggests there is still a quality preservation strategy at play, with consumers looking to stretch household budgets on less frequent purchases of better-quality wines.

Brand owners looking to tap into the momentum driven by younger adult consumers who are (re)discovering the wine category will need to adjust go-to-market strategies. The relationships younger LDA wine drinkers hold with alcohol differ from previous generations.

Younger LDA wine drinkers are:

1) More adventurous but less knowledgeable: wineries looking to talk to the new arrivals to the category have room to be more creative in their brand and messaging, particularly to communicate the value of their more premium products. These consumers are open-minded but yet to develop a knowledge base. Wine drinkers are becoming less interested in well-known brands and varietals.

2) Interested in moderation: low-alcohol wine does particularly well in the US, prompting some low-alcohol brands to highlight ABV rather than hide it. Examples within the wine category include Kim Crawford Wines’ Illuminate range, which uses lower ABV as a differentiating factor in its branding. This strategy is also evident in categories outside of wine. Body Vodka, for example, markets itself as containing 25% less alcohol than regular 40% ABV vodka. Meanwhile, Craft brewer Jack’s Abby is making lower-alcohol versions of classic styles under the umbrella name of the 2% Beer Initiative.

3) Open to alternative packaging: younger adult wine drinkers are more likely to purchase wine in formats such as cans and pouches which suit small-consumption or on-the-go drinking occasions.

4) Experience-led: the on-premise will need to provide experience-led drinking occasions to provide differentiation from the at-home occasion. Offering more creative tasting experiences and/or a wider range of wine varietals, can help drive excitement amongst younger LDA wine drinkers.

You may also be interested in reading:

Online alcohol sales in the US normalise after a surge during Covid-19 lockdowns

US alcohol sales in 2022 led by premium spending across all categories

Consumer confidence in the US remains broadly positive

The above analysis reflects IWSR data from the 2022 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, Wine | MARKET: All, North America | TREND: All |

Interested?

If you’re interested in learning more about our products or solutions, feel free to contact us and a member of our team will get in touch with you.